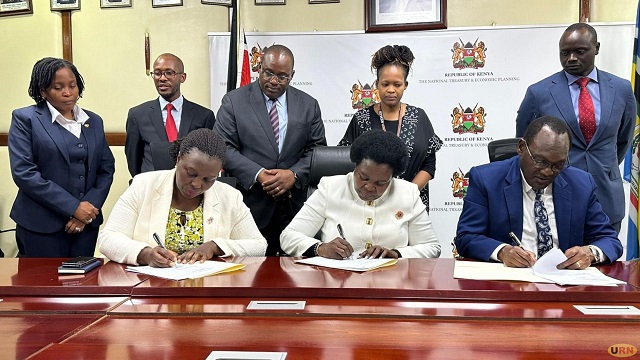

Nairobi, Kenya | THE INDEPENDENT | Uganda has finalized negotiations with Kenya over Kampala’s participation in the upcoming Initial Public Offering (IPO) of the Kenya Pipeline Company (KPC), marking a significant strategic shift in regional energy diplomacy. Energy Minister Ruth Nankabirwa Ssentamu and Attorney General Kiryowa Kiwanuka led a high-level delegation to Nairobi on Friday to seal Uganda’s entry into KPC’s shareholding structure.

The investment will be undertaken through the Uganda National Oil Company (UNOC), the state-owned entity mandated to manage Uganda’s commercial interests in the petroleum sector. Government officials described the move as a calculated step to guarantee long-term energy security for Uganda and cement its influence within the region’s petroleum supply chain.

“This is a deliberate strategic decision aimed at strengthening regional energy cooperation and safeguarding national interests,” Nankabirwa said in remarks to Uganda Radio Network. “The investment will enhance security of access to petroleum products, improve affordability, and reinforce long-term supply stability for Uganda and the wider region.”

KPC operates more than 1,700 kilometres of petroleum pipeline infrastructure across Kenya, transporting refined fuel from the port of Mombasa to Nairobi and onward to western Kenya, with supply links that ultimately feed into Uganda. Uganda imports virtually all of its refined petroleum products through Kenya’s port and pipeline system.

According to the Ministry of Energy and Mineral Development, Uganda consumes an estimated 2.3 to 2.5 billion litres of petroleum products annually, with demand growing at roughly 7–10 percent per year due to urbanisation, industrialisation, and a rising vehicle fleet. Any disruption along Kenya’s logistics corridor, whether at the Port of Mombasa, pipeline infrastructure, or cross-border transit points, has direct implications for fuel prices and supply stability in Uganda.

Past logistical bottlenecks and global oil price shocks have triggered price spikes locally, pushing petrol and diesel prices beyond UGX 6,000 per litre at peak volatility. By acquiring a strategic stake in KPC, Kampala is seeking not only financial returns but also board-level visibility and influence over infrastructure decisions critical to Uganda’s energy lifeline.

Permanent Secretary at the Energy Ministry, Eng. Irene Pauline Bateebe said Kenya’s recognition of Uganda’s strategic role in KPC operations signals a new phase in bilateral cooperation. “Following the IPO, Uganda looks forward to working closely with the Government of Kenya and other shareholders to advance the company’s business objectives, enhance operational efficiencies, and promote regional energy integration,” Bateebe said.

Attorney General Kiwanuka described the agreement as consistent with Uganda’s obligations and ambitions under the East African Community (EAC), which promotes economic integration, infrastructure harmonisation, and free movement of goods and services. Energy cooperation has increasingly become a pillar of EAC integration. The region is currently pursuing joint crude export infrastructure, including the East African Crude Oil Pipeline (EACOP), which will transport Uganda’s crude from Hoima to Tanzania’s coast for export.

Uganda’s move into KPC complements these efforts by consolidating its position across both crude export and refined product import corridors. Uganda’s investment comes at a pivotal moment in its petroleum journey. The country expects first oil production from the Tilenga and Kingfisher fields in 2026–2027, with peak output projected at 230,000 barrels per day. As production approaches, energy planners have increasingly emphasised the need to secure both upstream and downstream infrastructure.

While Uganda will export crude through Tanzania, it will continue to rely on imported refined products until a domestic refinery becomes operational. The government has long proposed a 60,000-barrels-per-day refinery in Hoima to reduce import dependence. However, financing and investor negotiations have faced delays. Until that refinery materialises, Uganda remains structurally reliant on Kenyan infrastructure for refined fuel supply.

Analysts say taking equity in KPC could cushion Uganda against future tariff adjustments, logistical constraints, and supply disruptions, risks that have historically amplified domestic fuel inflation.

While the government has framed the investment as strategic, financial analysts note that IPO participation carries market risks. The valuation of KPC, pricing of shares, and governance structure post-listing will determine whether Uganda’s stake yields both strategic leverage and commercial returns.

Transparency advocates are also likely to scrutinise the transaction, particularly the size of the stake, the funding mechanism, and the expected return on investment. UNOC, established under the Petroleum (Exploration, Development and Production) Act, 2013, is mandated to manage state participation in the petroleum sector on a commercial basis. Officials have not yet disclosed the size of the investment or the percentage stake Uganda intends to acquire. Uganda spends billions of dollars annually on petroleum imports, making fuel one of the country’s largest import bills and a key driver of inflation.

According to Bank of Uganda data, petroleum products consistently rank among the top import categories, exerting pressure on foreign exchange reserves. By embedding itself within the region’s largest petroleum pipeline operator, Uganda is effectively converting part of its recurrent import expenditure into an ownership stake in the supply chain.

“This milestone demonstrates Uganda’s commitment to deepening bilateral relations with Kenya and advancing regional integration,” Attorney General Kiwanuka said. If successfully executed, Uganda’s entry into KPC’s ownership structure could redefine the country’s role from passive fuel importer to strategic stakeholder in East Africa’s petroleum logistics architecture, a shift that may prove decisive as the region’s energy demand continues to surge.

****

URN