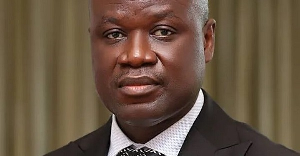

Ghana’s President, John Dramani Mahama, has identified Solana, a high-performance blockchain network, as a potential game-changer for fintech growth and cryptocurrency adoption across Africa.

In a recent social media post, Mahama stressed the importance of financial inclusion across the continent and pointed to Solana’s low transaction costs as a key driver for enabling cryptocurrency payments and investments.

He stated, “Financial inclusion isn’t just a need for Ghana—it’s essential for all of Africa. With its low transaction costs, #Solana could be the key to driving fintech growth and enabling cryptocurrency payments & investments across the continent.”

Solana is a blockchain platform designed for fast and scalable decentralised applications. Unlike traditional blockchains such as Bitcoin and Ethereum, which often struggle with high fees and slow transaction speeds, Solana offers lightning-fast processing times and significantly lower costs, making it an attractive option for financial services and payments.

The network’s unique proof-of-history (PoH) consensus mechanism allows for thousands of transactions per second, positioning it as a viable alternative for African fintech solutions.

Mahama’s endorsement of Solana aligns with his broader vision for Africa’s digital revolution.

Speaking in an accompanying video, he highlighted how technology can help Africa bypass traditional development hurdles. He said, “The Fourth Industrial Revolution presents a golden opportunity for Africa to leapfrog traditional development models. We don’t need to go back to inventing the wheel. Digital transformation can drive financial inclusion, improve public service delivery, and create new opportunities for all our people.”

He further called for investments in internet expansion, digital infrastructure, fintech, and research and development to bridge the digital divide and make Africa more competitive.

His comments come at a time when Ghana’s central bank is working to regulate the country’s cryptocurrency market. In August last year, the Bank of Ghana (BoG) issued draft regulations aimed at formalising oversight for digital assets.

These proposed guidelines include registration requirements for Virtual Asset Service Providers (VASPs), anti-money laundering compliance measures, and stronger internal controls for consumer protection. Additionally, the BoG is pursuing its own central bank digital currency, the eCedi, which was first announced in 2021 as part of Ghana’s digital finance innovation push.

Authorities, however, continue to caution against the volatility of cryptocurrencies, urging investors to be mindful of sharp price fluctuations.

Mahama’s remarks signal growing interest in blockchain technology as a tool for economic transformation in Africa.

“We wanted to be different but also be part of the problem-solving process because Rwanda at the time was banning plastic bags, which was such a huge inspiration for us. So, we thought how do we play a part in that and how do we contribute?” Kagirimpundu said. “We thought this creates something that would become a source of income for ourselves but also other young people like us.”

“We wanted to be different but also be part of the problem-solving process because Rwanda at the time was banning plastic bags, which was such a huge inspiration for us. So, we thought how do we play a part in that and how do we contribute?” Kagirimpundu said. “We thought this creates something that would become a source of income for ourselves but also other young people like us.”

“This aggression will not go without response and our Yemeni armed forces are ready to answer escalation with further escalation,” the group said.

“This aggression will not go without response and our Yemeni armed forces are ready to answer escalation with further escalation,” the group said.