Ghana’s First Atlantic Bank PLC (FAB) listed for trading on the Ghana Stock Exchange (GSE) on 19 December, after an oversubscribed initial public offering (IPO). The combined offer was for 101.7m ordinary shares at GHS 7.30 each to raise GHS 742 million ($64.6m).

Trading in the shares began the first day of the listing. On thin volumes the FAB share price climbed from GHS 7.30 to GHS 7.70.

The combined offer was for 101.7m ordinary shares at GHS 7.30 each to raise GHS 742 million ($64.6m), according to the 17 November prospectus (available here). This comprised 22.6m newly issued subscription shares to raise GHS 165 as proceeds for the bank, and a sale by existing shareholders of up to 79.1m sale shares (22.6% of the capital) for GHS 577m.

The sponsoring brokers were IC Securities (Ghana) and First Atlantic Brokers and the IPO Manager was Amber Securities.

The lender completed its IPO with an oversubscription, according to a FAB announcement circulated by the GSE, which unusually did not specify the amount. This report in MyJoyOnline says it was 120% subscribed. According to FAB’s press announcement of the listing; “The oversubscription of the offer reflects the bank’s consistent financial performance underpinned by sustained profitability, balance sheet growth and continued investment in digital banking infrastructure.” According to the prospectus, the company had already received firm commitments from a list of pension funds who had pledged to buy 94m shares for a total of GHS 688.4m, or nearly 93% of the offer.

The sale shares include 37m shares sold by A.A. Global Investments which is selling out completely and 12m shares from AFIG Fund II, a private equity fund run by Advanced Finance & Investment Group (AFIG), which will still own 79.5m shares after the offer (21.35%), assuming the offer is fully subscribed.

The money from the subscription offer will be used GHS 57.3m for working capital and GHS 92.2m for regional expansion, while offer costs were due to be up to GHS 15.5m (2.09% of the sum raised) including GHS3.0m in regulatory fees (including GHS 2.0m to the GSE).

The prospectus said that the offer would open on 24 November and close on 4 December. The SEC was due to approve the offer results on 17 December.

Funds for growth and bank expansion across borders

First Atlantic Bank is a locally owned bank, which started business under the First Atlantic name in 1995. It is a full-service universal bank, delivering a comprehensive suite of financial products and services to a diverse clientele that includes individuals, small and medium-sized enterprises, large corporates, public sector entities, and financial institutions. It delivers services through 35 branches, automated teller machines (ATMs), point of sale (POS) terminals, and a growing digital banking platform. It also acts as a custodian including to pension funds.

The listing announcement included: “The bank has prioritized technology-driven innovation, risk-management compliance and customer-centric product development to strengthen its competitiveness in Ghana’s banking sector”. FAB board and management thanked the regulators – Bank of Ghana, Securities and Exchange Commission, National Pensions Regulatory Authority and Ghana Stock Exchange – for their support.

“Looking ahead, First Atlantic Bank is expected to leverage its strengthened capital position to support business growth, deepen financial inclusion, enable its regional expansion plans and contribute to the development of Ghana’s capital markets, while delivering sustainable returns to shareholders.”

According to a report on BusinessDay Nigeria, Amarquaye Armar, chairman of FAB’s board, said: “The commencement of our journey toward becoming a publicly listed institution is a bold and strategic step for the bank. It reinforces our commitment to strong governance, sustainable value creation, and the pursuit of growth opportunities that will benefit our customers, shareholders, and communities.

Bank of Ghana pushes for listings

The regulator, the Bank of Ghana, is encouraging local issuers and investors to take advantage of the opportunities offered in the Ghanaian equities capital market.

According to statement Bank of Ghana Governor Johnson Pandit Asiama told the listing ceremony: “By taking this step, First Atlantic Bank is strengthening its capital base, broadening ownership, and contributing to the deepening of Ghana’s capital market. It reinforces confidence in the financial system and supports building a more transparent, resilient, and forward-looking financial sector.

“As Ghana’s economy grows and financial intermediation becomes more sophisticated, we expect more banks to access the equity market, strengthening links between banking and capital-market development. By 2026 and beyond, a more diversified ownership structure will enhance resilience, reduce concentration risks, and support a financial system aligned with national development objectives.”

BusinessDay Nigeria reports “The listing comes just a few weeks after the Bank of Ghana renewed calls for more lenders to list on the GSE to deepen liquidity and attract long-term investment.

“The renewed push coincides with improving sentiment in Ghana’s equities market following years of macroeconomic stress. The GSE Composite Index (GSE-CI) has risen more than 318% over the past decade, reflecting gradual recovery and renewed trading activity.

“Yet participation remains limited. Out of Ghana’s 25 universal banks, only 11 are currently listed, restricting access to long-term equity capital… The GSE remains one of Africa’s smallest stock exchanges.” The GSE has 36 listings and FAB is its 12th listed banking stock. (GSE listings page is here).

The most recent listings on the GSE were: Atlantic Lithium in May 2024 (see London Stock Exchange announcement ) and Asante Gold Corporation in June 2022 (see GSE announcement). Both listed by introduction for a secondary listing in Ghana as they have primary listings elsewhere.

The newspaper quotes Ebenezer Ndoor, a Ghanaian-based economic policy analyst: “The GSE has long struggled with low liquidity and limited trading volumes.. Bringing more banks on board means more shares to trade, more investor participation, and ultimately a more vibrant market.”

He added that public listing imposes stricter disclosure, independent audits and accountability to shareholders. Improved governance standards in the banking industry would benefit depositors, investors and regulators.

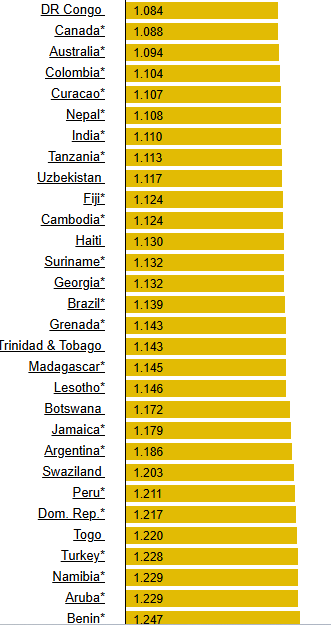

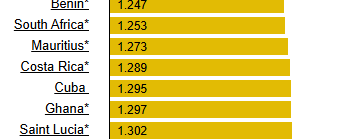

The paper notes “sentiment is gradually shifting. After sharp depreciations in 2023 and 2024, the cedi emerged as Africa’s best-performing currency in the first eight months of 2025, helping to restore investor confidence and revive interest in Ghana’s equity market.”