By Iddi Yire

Accra, Mar 08, GNA – The Government has debunked claims by Mr Samuel Abu Jinapor, New Patriotic Party (NPP) Member of Parliament (MP) for Damongo, that President Mahama John Dramani Mahama has appointed hundred ministers.

The MP made the claims on the floor of Parliament while contributing to the debate on the President’s State of the Nation Address.

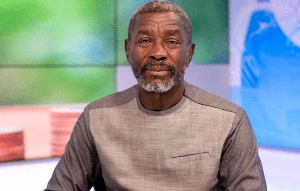

However, Mr Felix Kwakye Ofosu, the Presidential Spokesman and Minister of State in-charge of Government Communications, speaking to the press at the Seat of Government in Accra reiterated that the President had kept to his campaign promise of appointing 60 ministers; declaring that so far he had appointed 56 Ministers and Deputy Ministers, with four more outstanding Deputy Ministerial Nominations yet to be made by the President.

Touching on appointment of Presidential Staffers, Mr Ofosu said President Mahama had appointed 27 Staffers and three Directors at the Presidency, making a total of 30.

He said President Mahama made a firm commitment that he was going to cut down on the size of government and that he had put a specific number to the ministers that he would be appointing.

“Everybody heard him say he would appoint 60 ministers. That includes deputy ministers. He also made it clear that he was going to cut down on the number of political appointees at the Office of the President,” the Minister said

“Now, regarding ministers, he has done exactly as he promised. As I speak, he has made 56 nominations for ministerial positions. All the ministers of state have been approved and passed by Parliament and have been sworn into office and are working, including my good self.”

He said there were deputy ministerial nominations currently before Parliament, and all of them had gone through vetting at the Appointments Commitment and that they were expecting that they would be approved by Parliament in the next few days, after which they would be sworn into office.

He reiterated that there were four outstanding deputy ministerial nominations that the President would be making, which when he makes them, they would make it known to the people of Ghana.

“Now, when it comes to the Presidential Staff, the Damongo MP claims that the President is making up for the shortfall in ministers with appointments at the Presidency,” Mr Ofosu said.

It is disappointing because he once worked here as a Deputy Chief of Staff, so you would expect him to be familiar with these matters and their positions.

“Let me put it on record that everybody who has been appointed as a Presidential Staffer has been named in a statement put out by myself.”

He said currently, there were 27 presidential staffers and that all of them were announced, unlike in the past NPP administration, where Ghanaians only learned of them when the President submits a list of the Presidential staff to Parliament.

This time, he said the Mahama Administration went ahead to inform the people of Ghana about this list and left nobody in doubt about the numbers.

Mr Ofosu said in addition to these 27 Presidential Staffers, three people had been appointed to assist with some specific interventions that the President wants to embark upon, and that they were referred to as Directors; saying “They do not have the ranking of Presidential Staffers. At best, they can be described as Presidential Aides. There are just three of them.”

“If you add it to the list of Staffers, that is 30. Beyond that, no other staffers or presidential aides have been appointed.”

Giving an analysis of the number of Presidential Staffers appointed by the previous Akufo-Addo Administration and the current Mahama Administration, Mr Ofosu said in 2017, when the NPP first came to office, they had a total of 27 staffers and 256 political appointees, nine ministers of state who worked at the Presidency, who one could count them amongst the 126 ministers.

He said 2020, when the NPP Government presented a Presidential Staff list to Parliament, there were 36 presidential staffers and 270 political appointees at the office of the President, which excluded the civil servants.

He said there were over 700 civil servants who worked at the Office of the President under the NPP Government; stating that, that number had remained the same, barring some changes.

Adding that these were civil servants who were seconded to the office of the President.

He said the civil servants at the Office of the President came from various Government departments and agencies.

He said so often, in the analysis, they were not factored in, in terms of additions that had been made to the size of government. “We often highlight the numbers of political appointees.”

Mr Ofosu said there were 306 political appointees at the Office of the President under the NPP Administration in 2022.

He said the data was contained in reports to Parliament, so they were matters of public record.

He said when they presented the reports for 2022, it turned out that there were 44 presidential staffers and 292 political appointees.

He said in all, there were 336 political appointees who worked in the Office of the President under the NPP in the year 2022; and that the numbers remain the same for 2023 and 2024.

Mr Ofosu underscored that President Mahama would come nowhere close to this number.

He said when it comes to the staff at the Office of the President, President Mahama had committed to reducing the numbers drastically and therefore, by every account, this government would be the smallest in the history of Ghana.

He noted that it was important because it enables the government to make significant savings.

“So, I wanted to set that record straight and debunk any notion that this government comes anywhere near what the NPP did when we’re in power.”

GNA

![Emmanuel Bedzrah [L] and Alexander Afenyo-Markin Emmanuel Bedzrah [L] and Alexander Afenyo-Markin](https://cdn.ghanaweb.com/imagelib/pics/247/24729675.295.jpg)