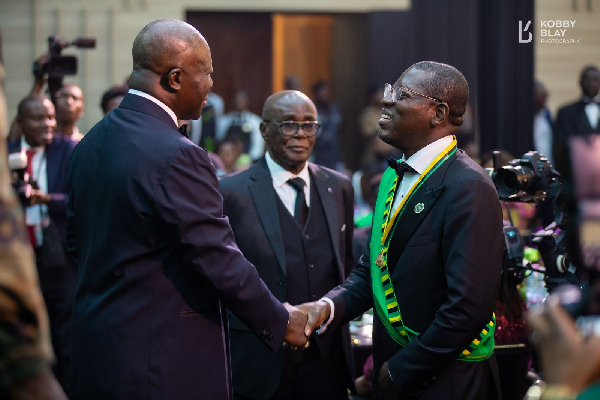

Economist, Professor Godfred Bokpin

Economist, Professor Godfred Bokpin

Renowned economist and Professor of Finance, Godfred Bokpin, has dismissed claims that the GH¢1 fuel levy and the controversial Electronic Levy (E-Levy) implemented under the New Patriotic Party (NPP) government are similar.

Some critics have drawn parallels between the two taxes, arguing that both measures place an undue burden on consumers.

However, speaking on Morning Starr, Prof. Bokpin countered that while the E-Levy was fundamentally flawed and economically unjustifiable, the fuel levy is necessary under current circumstances.

Prof. Bokpin explained that prematurely taxing the growing digital economy, as was done with the E-Levy, was a misstep.

“They are not similar. They are on different pathways. I am unable to situate these levies side by side with the E-Levy, not at all. The E-Levy did not meet the basic principles of taxation in economics, and from conceptualization to implementation, it was clearly flawed,” he stated.

He emphasized that the global transition toward a digital economy should be nurtured, not taxed harshly in its early stages.

“If you look at the economy, the traditional economy, based on bricks and mortar, versus the digital economy, driven by apps and technology — the projection is that the digital economy will expand faster. The global shift is increasingly toward digital platforms.”

“Even within finance, the future is digital. These days, we talk about digital economics, digital finance, and digital currency. The future of money and business is digital, so digitization should not be merely used as a taxation tool,” he added.

Prof. Bokpin argued that even leaders within the NPP, including its flagbearer and then-Vice President, acknowledged that the E-Levy was a mistake, describing it as a classic case of a “nuisance tax.”

“And we all agree, even including the vice president at that time, and the flag bearer of the NPP, that E-Levy had to go. There are taxes that can be classified as nuisance taxes, and E-Levy was one of them,” he asserted.

In contrast, he defended the GH¢1 fuel levy, describing it as a pragmatic move, especially considering the recent appreciation of the cedi, which has helped ease fuel prices at the pump.

“Given that there is aggressive spending of the currency, the impact of the fuel levy will not be as heavy on consumers compared to times of severe economic volatility,” he explained.

The GH¢1 fuel levy was introduced through the Energy Sector Levy (Amendment) Bill, 2025, which Parliament passed on Tuesday, June 3.

The measure imposes a GH¢1 tax on every liter of petroleum product, a decision that has drawn criticism from transport unions, the general public, and the Minority in Parliament.

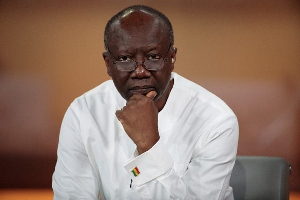

However, government officials, including Finance minister, Dr Cassiel Ato Forson, have defended the levy, calling it a necessary intervention to address the country’s $3.1 billion energy sector debt.

The Minister also assured Ghanaians that the new tax would not lead to an increase in fuel prices, citing recent gains in the cedi’s value.

Revenue from the levy is expected to fund fuel purchases for electricity generation, helping to minimize power outages and stabilize the national grid.

Watch drivers react to government’s new GH¢1 energy levy on petroleum products