Management of the University of Ghana (UG) has clarified that the reported over 25% increase in academic fees for the 2025/2026 academic year across all colleges is largely due to third-party charges imposed by student leadership, and not by the university authorities.

The clarification follows concerns raised by students over what they describe as a significant hike in academic fees, with the provisional fee schedule showing substantial increases affecting both fresh and continuing students.

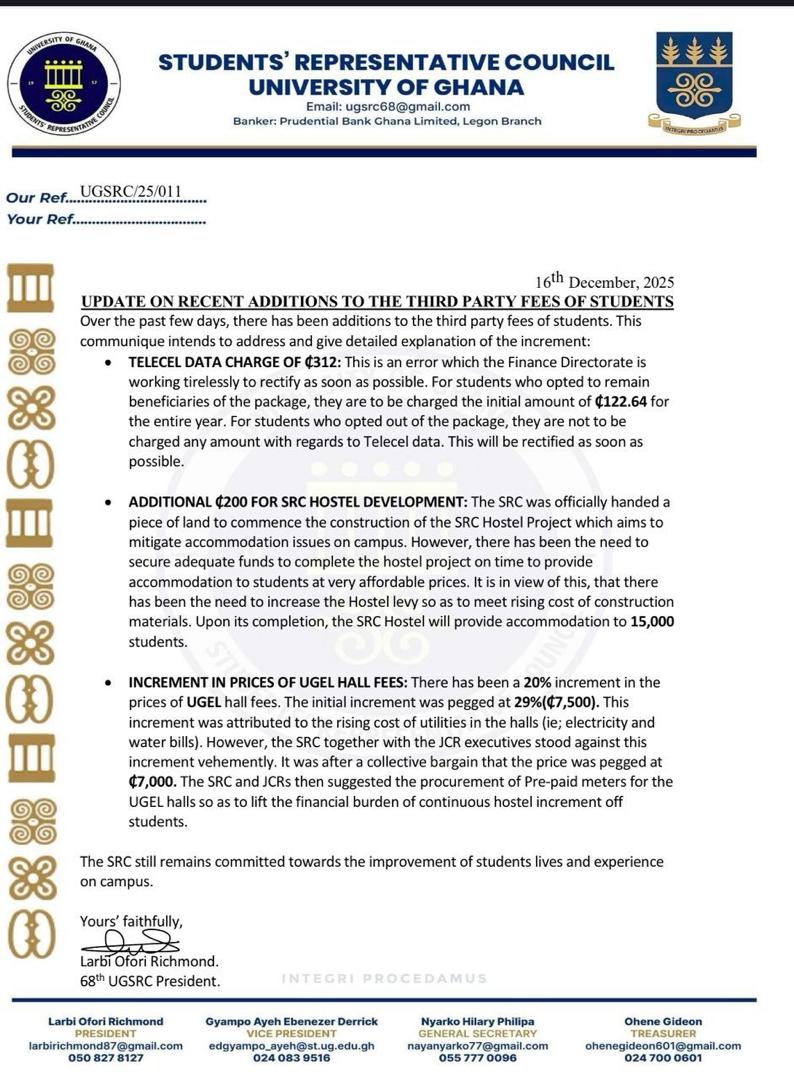

According to the university, the increases are mainly attributed to fees imposed by the Students’ Representative Council (SRC) and the Graduate Students’ Association of Ghana (GRASAG) to support their activities. Management has therefore urged students to channel their concerns to their respective student leadership bodies.

Speaking to Citi News, the Pro Vice-Chancellor of the University of Ghana, Professor Gordon Awandare, explained that management has limited control over third-party fees included in the overall academic charges.

“What is being reported as fee increases relates to third-party fees imposed by student leadership. These are fees approved through their own governance structures and communicated to students over two weeks ago. University management did not impose these fees. If students have issues with these charges, they should take them up with their SRC or GRASAG leadership. These fees are meant to support student programmes and activities.” he explained.

Professor Awandare further argued that the overall academic fees charged by the University of Ghana remain relatively modest, considering prevailing economic conditions.

“When you look at the fees about GHS2000 for an entire academic year at Ghana’s premier university it is difficult to describe them as excessive. Utilities and operational costs have increased significantly, yet university fees have largely remained unchanged since 2022. Even the students themselves recognise that the previous fee levels were no longer realistic under current economic conditions, which is why they have adjusted their component of the fees to match the cost of running their activities.” he said.

Management maintains that the current adjustments reflect economic realities rather than unilateral decisions by the university.

Below is a statement from the SRC indicating that the fees were imposed by the student leadership