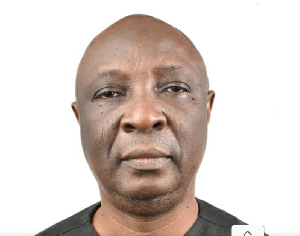

Prof. Adeola Adenikinju is the President, Nigerian Economic Society

Prof. Adeola Adenikinju is the President, Nigerian Economic Society

Nigeria risks being left behind in the ongoing global energy transition if it fails to strategically monetise its oil and gas reserves.

This was stated by a former President of the Nigerian Economic Society, Prof. Adeola Adenikinju, who advocated a balanced deployment of renewables and conventional energy sources to provide electricity access to the 87 million Nigerians currently without energy security.

Speaking on Monday in Abuja at the 18th NAEE/International Association for Energy Economics Annual International Conference, Adenikinju, in his keynote address, said the global energy landscape has become increasingly complex and volatile, shaped by wars, artificial intelligence, and shifting geopolitical alliances.

The IAEE/NAEE conference, now in its 18th edition, brings together top policymakers, academics, and energy executives to discuss emerging issues in the global and African energy landscape.

This year’s theme, “Emerging Geopolitics of Energy: Navigating Global Shifts and Impact on Emerging Countries”, focused on the intersection of global politics, climate policies, and the future of developing economies.

According to him, “The global energy market today is impacted by several layers of interlinked factors, from rising geopolitical tensions and wars to the exponential growth of data centres to support artificial intelligence and the slow pace of energy efficiency growth.

All these have significant implications that ripple across countries and regions.”

Turning to Nigeria, Adenikinju painted a stark picture of an oil-rich nation crippled by energy poverty.

“Nigeria ranks among the top producers of oil and gas globally, yet over 87 million Nigerians have no access to electricity,” he lamented. “We are the largest exporter of crude oil in Africa and yet the biggest importer of refined petroleum products. That is an unacceptable paradox.”

He said the country must quickly monetise its oil and gas resources before global demand peaks, warning that “as the world transitions to a low-carbon economy, our hydrocarbons could become stranded assets if we fail to act decisively.”

“The options for Nigerians are very clear. Nigeria must aggressively exploit its huge oil and natural gas reserves as the world transitions away from a carbon-dominated global economy. As the energy transition accelerates, the global demand for oil peaks sooner than expected.

“Nigeria must aggressively exploit its huge oil and gas reserves while simultaneously scaling up investments in solar, hydro, and wind power.”

Adenikinju noted that the war in Ukraine and the “weaponisation of energy” had upended decades of energy interdependence between Europe and Russia, sparking record prices for liquefied natural gas and crude oil.

“Before 2022, the EU relied on Russia for about 40 per cent of its natural gas imports. That figure has fallen drastically as countries scramble for alternative supplies,” he explained, adding that the resulting global shift has revived the age-old question of energy security.

He stressed that the transition to cleaner energy, though necessary, has introduced new forms of volatility. “Policies like the EU Green Deal and the U.S. Inflation Reduction Act are reshaping global supply chains for critical minerals like lithium, cobalt, and copper,” he said.

He also pointed to the strategic competition between the United States and China over technological dominance in renewable energy and battery storage, which he described as a new front in the geopolitics of energy.

“China currently controls over 80 per cent of global solar panel manufacturing and critical mineral processing. This is forcing countries, especially developing ones, to make tough choices about who to align with,” he noted.

Citing the latest International Energy Agency data, Adenikinju said global economic uncertainty had become a key driver of energy instability, influencing oil prices, financing costs, and investment flows.

He explained that, “The IMF in its July 2025 World Economic Outlook described the global outlook as one of ‘tenuous resilience amid persistent uncertainty.’ This uncertainty fuels volatility in oil and gas markets, deterring long-term investments, especially in developing countries.”

He warned that capital flight and high interest rates could jeopardise large energy projects in countries like Nigeria. “When uncertainty rises, the option value of waiting increases. Developers delay financial investment decisions or demand higher returns,” he said.

The economist urged African countries to move beyond exporting raw materials for clean energy technologies.