Ghana’s private sector experienced a slight contraction in September as business output fell for the third consecutive month, despite continued growth in new orders and sustained employment increases. The mixed signals suggest an economy struggling to convert customer demand into actual production amid material sourcing challenges and currency fluctuations.

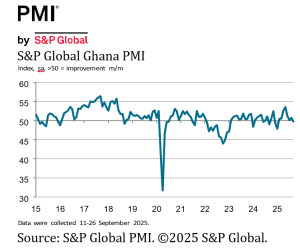

The S&P Global Ghana Purchasing Managers’ Index dropped to 49.8 in September from 50.8 in August, ending a seven-month growth streak. A reading below 50 indicates contraction while anything above signals expansion, making this month’s figure particularly significant as it marks the first deterioration in overall business conditions since February.

The disconnect between rising orders and falling output presents an unusual economic puzzle. New orders extended their expansion sequence to eight months, suggesting customers remain willing to purchase goods and services. However, companies reported they couldn’t translate that demand into increased production, with output declining for three straight months.

Andrew Harker, Economics Director at S&P Global Market Intelligence, acknowledged this persistent challenge. Companies in Ghana struggled to convert new order growth into business activity increases, he noted, with output down for the third consecutive month. The pattern suggests deeper issues beyond temporary disruptions.

Survey respondents attributed the output decline to difficulties sourcing materials and recent exchange rate fluctuations. These explanations reveal how external factors can constrain business operations even when customer demand remains healthy. A company with orders can’t fulfill them without necessary inputs, regardless of how strong sales prospects might be.

The currency dimension adds complexity to Ghana’s economic situation. Earlier in the year, the cedi’s appreciation against the US dollar helped limit purchase price inflation, making imported materials more affordable. However, the currency gave back some ground during September, contributing to rising costs for purchased items and complicating planning for businesses dependent on imported inputs.

On a positive note, lower selling prices reportedly helped support customer demand during September. Companies reduced their output prices for the fifth consecutive month, though the pace of decline was the slowest in that sequence. Client recommendations also contributed to new order growth, suggesting satisfaction with products and services despite operational challenges.

The employment picture remained encouraging, with staffing levels increasing for the eighth consecutive month. Companies added workers to handle new order inflows, though the rate of job creation was the slowest since April. Rising workforce numbers helped firms manage workloads, allowing them to reduce outstanding business again in September.

Firms also increased purchasing activity for the eighth successive month, with stocks of inputs rising as a result. Inventory accumulation has been recorded monthly throughout the past year, indicating companies are building buffers against supply chain uncertainties even as they struggle with current production levels.

Supplier performance improved markedly amid strong competition among vendors, with lead times shortening to the greatest extent since May. This development offers hope that material sourcing difficulties might ease in coming months, potentially allowing companies to better convert orders into output.

Inflationary pressures showed mixed signals. Input costs increased slightly for the first time in five months, ending a period of falling costs that had helped businesses lower their selling prices. However, the rate of input cost inflation remained much weaker than the historical average, suggesting price pressures remain relatively subdued.

Companies reported increases in both purchase prices and staff costs at the end of the third quarter. Higher staff costs reflected cost of living payments to workers in some cases, but also the impact of rising employment. The wage increases acknowledge inflation’s effect on workers while potentially adding to business cost pressures.

Business confidence remained strongly positive despite operational challenges. Companies expressed optimism about future prospects, suggesting they view current difficulties as temporary rather than indicating fundamental economic problems. This sentiment helps explain continued employment and purchasing increases even as current output falls.

The survey results paint a picture of an economy in transition, where positive indicators like order growth, employment gains, and business confidence coexist with production challenges and currency pressures. Whether this represents temporary adjustment or signals more persistent problems will become clearer in coming months.

For policymakers, the data presents both encouragement and concern. New order growth and employment increases suggest underlying economic strength, while falling output and currency fluctuations indicate vulnerabilities requiring attention. The challenge involves addressing material sourcing and exchange rate issues without undermining the positive demand trends.

The private sector’s struggle to convert orders into output raises questions about supply chain resilience and infrastructure adequacy. Even with willing customers and available workers, production can’t happen without reliable access to necessary materials at predictable prices. These structural issues often require long-term solutions beyond monetary or fiscal policy adjustments.

Currency stability emerges as particularly important for Ghana’s import-dependent businesses. The cedi’s earlier appreciation helped control costs, but subsequent depreciation demonstrates how quickly benefits can reverse. Sustained exchange rate stability would help businesses plan more effectively and reduce the material sourcing challenges respondents identified.

The continued employment growth despite falling output suggests companies maintain optimism about near-term prospects. Businesses typically don’t hire additional workers if they expect prolonged contraction. The willingness to expand workforces indicates confidence that current production challenges will be resolved, allowing them to fulfill the orders already secured.

Looking ahead to the fourth quarter, several factors will influence whether Ghana’s private sector returns to expansion. Supplier performance improvements could ease material sourcing difficulties. Continued muted input cost inflation would allow businesses to maintain competitive pricing. And sustained new order growth provides the foundation for output increases if operational challenges can be resolved.

Harker expressed hope that continued subdued cost pressures and falling output prices will support new order growth and feed through to output increases in the final quarter. That optimism rests on assumptions that material sourcing improves and exchange rates stabilize enough to support production planning.

The broader context involves Ghana’s economic positioning within regional and global markets. As a relatively small, open economy, Ghana remains vulnerable to external shocks affecting both demand for its products and costs of imported inputs. Building resilience requires diversifying supply chains, strengthening domestic production capabilities, and maintaining macroeconomic stability.

For businesses operating in Ghana, the current environment demands careful navigation of competing pressures. Customer demand remains healthy, justifying continued investment in workforce and inventory. However, production challenges require flexibility in operations and close attention to supply chain management. Companies that successfully balance these demands will be best positioned when conditions improve.

The September PMI results serve as reminder that economic recovery rarely follows straight lines. Periods of growth alternate with contraction even as overall trends move in positive directions. The key question involves whether current challenges represent temporary setbacks within a broader expansion or early warnings of more significant problems ahead.