Bank of Ghana’s new headquarters

Bank of Ghana’s new headquarters

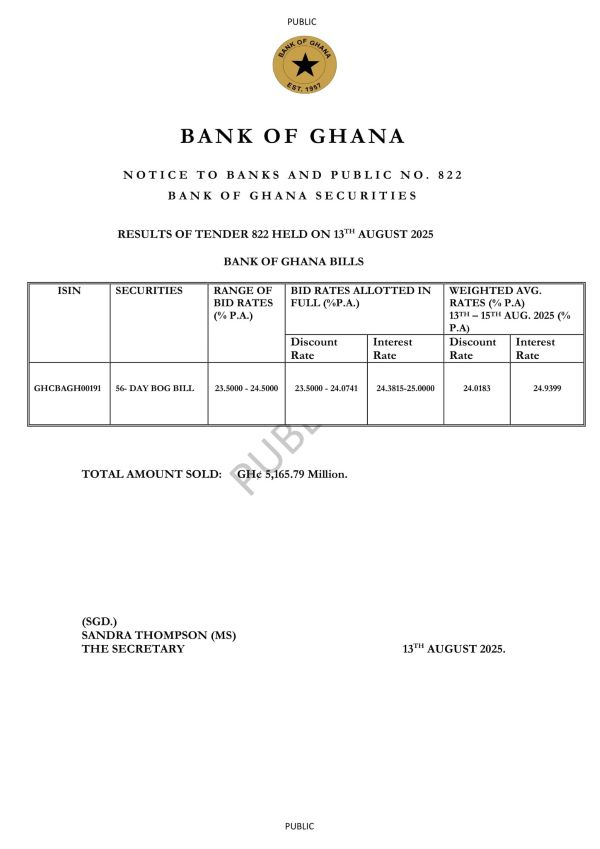

The Bank of Ghana has raised GH¢5.16bn through the sale of 56-day bills, as the central bank continues to deploy open market operations to manage liquidity in the banking system.

The bills, auctioned on August 13, 2025, at an interest rate of 24.9 per cent, form part of the BoG’s short-term securities programme aimed at regulating money supply and influencing market rates.

The auction results did not disclose the level of bids received or the issuance target.

BoG moves to reduce credit risk, enhance liquidity

Proceeds from such issuances are often channeled to the government to meet short-term financing needs, while the yields serve as a key indicator of the central bank’s monetary policy stance.

SP/AE

‘Last Wave’: Defence Press Corps captures Dr Omane Boamah’s final assignment