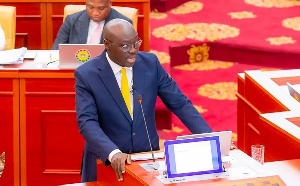

Dr Cassiel Ato Forson is the Minister of Finance

Dr Cassiel Ato Forson is the Minister of Finance

The Minister of Finance, Dr Cassiel Ato Forson, has explained the decision by the government to delay the abolishment of the COVID-19 Levy.

According to him, this is because it has to complete ongoing Value Added Tax (VAT) reforms.

He also linked the decision to the fact that the government needs to undergo the necessary business and stakeholder engagements.

The minister said this during an engagement on JoyNews on July 24, after the presentation of the 2026 Mid-Year Budget Review.

During the presentation, he noted that the abolishment of the COVID-19 Levy as part of new VAT reforms is to be considered in October.

According to him, the Ministry of Finance is preparing a new VAT bill to be ready by October 2025 and submit the same to Parliament as part of the 2026 Budget Statement.

He noted that under the new VAT reforms:

1. COVID-19 Levy will be abolished;

2. The effective VAT rate will be reduced;

3. The cascading effect of the GETFund and NHIS levies will be removed;

4. VAT flat rates will be removed;

5. Unified VAT rate will be implemented;

6. The VAT registration threshold will be increased to exempt small and micro businesses; and

7. Compliance will be improved through public education and the introduction of fiscal electronic devices.

SSD/AE

Watch the latest episode of BizTech below: