The Cedi gained nearly 16% against the US dollar since the beginning of the month

The Cedi gained nearly 16% against the US dollar since the beginning of the month

The Ghanaian cedi has been named the world’s best-performing currency in April 2025, gaining nearly 16% against the US dollar since the beginning of the month, according to Bloomberg.

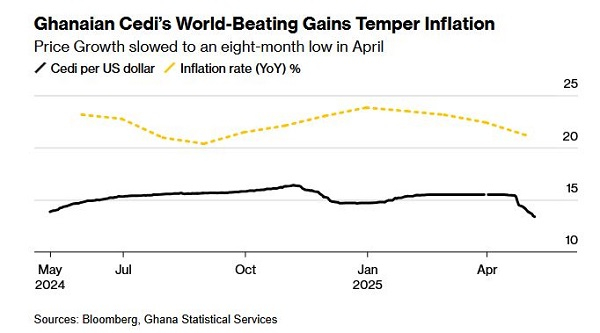

This significant appreciation has brought relief to Ghana’s economy, helping to curb inflation and strengthen consumer confidence. As of May 8, 2025, the cedi is trading at GH¢13.4 to the dollar, its strongest level in months. The currency’s rally has contributed to a notable drop in inflation.

Government Statistician, Dr Alhassan Iddrisu, on May 7, 2025, announced that consumer price inflation fell to 21.2% in April, down from 22.4% in March, marking the lowest level in eight months. Monthly inflation also slowed to 0.8%, largely driven by reduced import costs due to the cedi’s strength.

“A rally in the cedi reduced the cost of imports,” Dr Iddrisu noted, attributing much of the inflation relief to the local currency’s strong performance.

According to Bloomberg data, the cedi outpaced every other global currency in April in terms of gains against the US dollar. This marks a major turnaround for a currency that had faced steep depreciation amid Ghana’s economic crisis just over a year ago.

Despite the positive developments, some economists have urged caution.

According Dr. Agyapomaa Gyeke-Dako, a senior lecturer at the University of Ghana Business School, believes the Bank of Ghana will likely maintain its tight monetary stance in the short term.

“It tightened at its last meeting to mop up any excess liquidity. So now the central bank action going forward may not readily reduce the monetary policy rate yet because there might still be some threats to inflation coming from the hikes in utility prices,” she is quoted by Bloomberg.

Additionally, a senior credit analyst at REDD Intelligence said the Bank of Ghana may also be reluctant to ease policy as “easier monetary conditions could rekindle inflationary pressures.”

In March this year, the Monetary Policy Committee (MPC) of the Bank of Ghana raised the policy rate by 100 basis points to 28% to control inflation.

While the central bank has signaled its readiness to adjust policy based on inflation trends, it remains cautious about premature easing.

ID/MA

Watch the latest edition of BizTech below:

Click here to follow the GhanaWeb Business WhatsApp channel