Vice President Kwesi Amissah Arthur on Tuesday said it behooves banking institutions in the country to chart a new course in their operations with regard to the improvement in the economy.

He saidBanks in the country are too comfortable. So it’s time we force them to move from their comfort zones of buying treasury bills and relying on fixed incomes and rather move in a different direction by developing instruments that can motivate clients to save for the long-term that can then be used to finance long-term investments in the country.

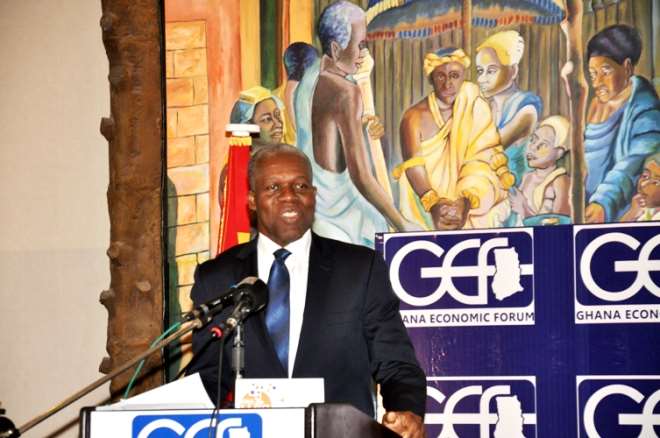

Vice president kwesi Amissah Arthur made the call when delivered the keynote address at a two-day forum organized by the Business & Financial Times, which brought together key public and private sector players to diagnose the challenges confronting Ghana’s economy and proffer solutions at the Movenpick Hotel in Accra

Vice-President Amissah Arthur said the nation’s socio-economy had successfully been positioned and as part of the reasons why Ghana went to negotiate an IMF programme was to revive transformation agenda and help diversify the economy.

The Vice president said we need to move from current spending to capital spending and also channel funds from the oil sector to productive investments.

He said the short term, the goal of government is to make fiscal adjustment, ensure debt sustainability and eliminate fiscal dominance of monetary policy.

Mr Amissah Arthur said government currently wants to ensure and facilitate local content participation, and has a vision of making sure that the power sector succeeds in order to solve some of the problems. Adding that what is being done now is to help in ensuring that the facilitation of local content participation was not limited to oil and gas but in all other sectors such as power to guarantee enhance welfare of its citizens.

On his part the Chief Executive of the Ghana National Petroleum Corporation, Mr. Alex Mould, said he was happy to be part of the programme because of its non-partisan nature.

He said in discussing Local content in the oil industry it means sharing investment with Ghanaian businesses.so the importance of banks in the country cannot be overemphasized when it comes to the subject of local content because they have a critical role to play as stakeholders.

Adding that total savings in Ghana alone is not enough for GNPC to participate in the oil industry so that is why they are looking at foreign direct investments to help them grow. He called on the media saying that Ghana has some of the world’s most vibrant radio stations but what we need to do is to execute all our discussions into projects that are viable for the wellbeing of the country.

The Deputy Finance Minister Mornah Quatey said the Ministry is of Finance was glad to partner the organisers for the event. Adding Economy in 13th consecutive year improvement, Growth peaked in 2011 at 14 percent but slowed down to 4 percent because of gas shortages, cedis depreciation etc. and also Inflation has eased slightly to 16 percent in 2015 but we expect a better growth going forward.

She said Government is very much aware of the challenges brought by fiscal imbalances, depreciating cedi, energy challenges, and also our dependence on imports not helping. Poor prices for commodities such as cocoa and gold harmed the economy. Resultant effect is increase in the cost of borrowing.

Mrs. Mornah Quatey, further stated that currently government is not looking at short-term solutions but a long-term view and that in 2014 government adopted ambitious home-grown solutions.

Objectives and policy measures of IMF programme align properly with government’s own home-grown solutions. So government would use fiscal space to expand social safety net spending in areas such as LEAP and basic healthcare.

On her part the chief Executive officer of the B&FT, Edith Dankwa, said their newspaper was happy to be part of search for solution.at a time that the forum seeks to create a platform to debate and find solutions to the problems confronting the country.

This article has 0 comment, leave your comment.